- Finance & Corporate Services

- Community Services

- Mental Health Resources

- Emergency Numbers

- CNP Adult Education

- Crowsnest Community Library

- Community Grants

- Community Groups

- Early Childhood & Youth Programs

- Family and Community Support Services

- Government Agencies

- Little Free Libraries and Book Exchanges

- Medical Clinics

- Real Estate & Property Management

- Schools

- SPCA

- Protective Services

- Operational Services

- Environmental Services

- Employment Opportunities

- Volunteer Crowsnest

- Emergency Preparedness

Government of Alberta - Property Tax Late Payment Reimbursement Program

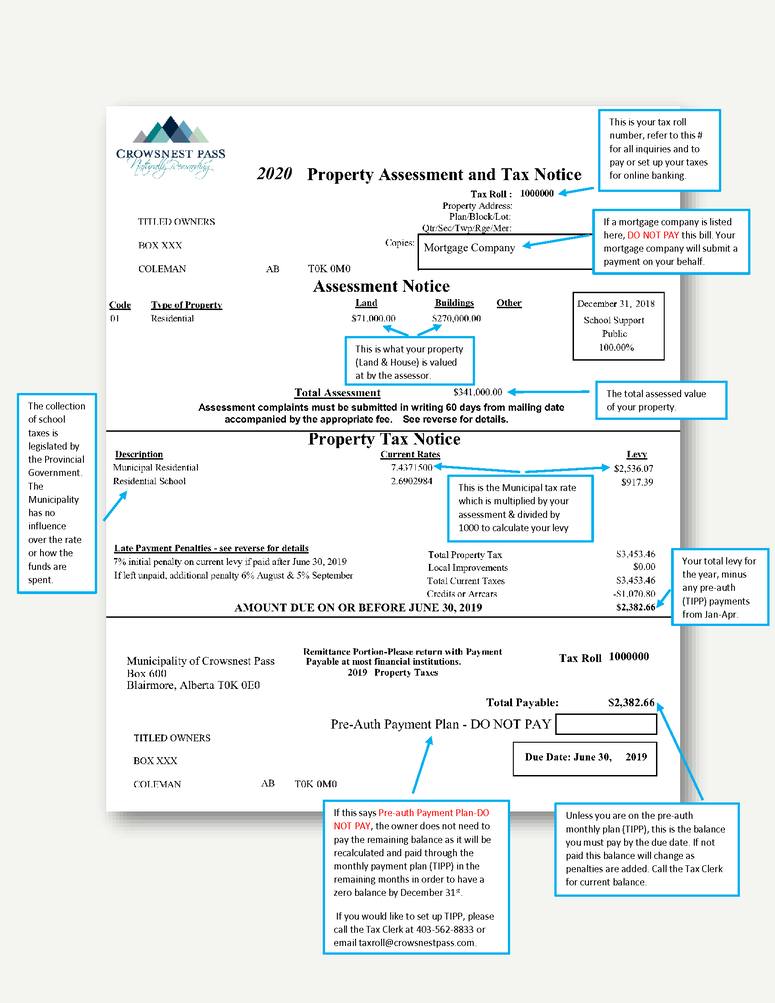

How to Read Your Residential Tax Notice

Property Taxes

How is my property tax levy calculated?

There are three components to the total Mill Rate:

- CNP Seniors Housing rate – set by Council; based on budget and operational needs of CNP Seniors Housing – this money is collected by the Municipality

- Municipal rate – set by Municipal Council based on budget and operational needs of the Municipality. This is the portion of property taxes that the Municipality collects for operational and capital needs.

- School rate – set by the Province based on assessment value – information about how the amount is calculated and how the funds are spent can be found at education.alberta.ca/admin/funding.aspx

Assessed Property Value X Total Mill Rate = Property Tax Levy

Eg. If your 2023 residential property assessment is $250,000

$250,000 X (10.0329 / 1000) = $2508.23

Here is a comparison over the last three years for Residential/Farmland property tax rates and levies based on $250,000 assessment:

|

2023 Rate |

Levy |

2022 Rate |

Levy |

2021 Rate |

Levy |

|

|

Municipal Tax Rate |

7.7943 | $1948.58 | 7.6415 | $1910.37 | 7.6415 | $1910.37 |

|

Alberta School Taxes |

2.1191 | $529.78 | 2.65 | $662.50 | 2.56 | $640.00 |

|

Seniors Housing |

0.1195 | $29.87 | 0.1328 | $33.20 | NA | NA |

|

Total |

10.0329 | $2508.23 | 10.4243 | $2606.07 | 10.2015 | $2550.37 |

2023 Non-Residential and Industrial/Linear Mill Rates

*Levy calculation based on $325,000 assessment.

|

Municipal Tax Rate |

Levy |

Alberta School Tax |

Levy |

Seniors Housing |

Levy |

Designated Industrial |

Levy |

Total Rate |

Total Levy |

|

|

Vacant Non-Residential |

13.3658 | $4343.89 | 2.9821 | $969.18 | 0.1195 | $38.84 | NA | NA | 16.4674 | $5351.91 |

|

Small Business Property |

13.3658 | $4343.89 | 2.9821 | $969.18 | 0.1195 | $38.84 | NA | NA | 16.4674 | $5351.91 |

|

Other Non-Residential |

17.8212 | $5791.89 | 2.9821 | $969.18 | 0.1195 | $38.84 | 0.0746 | $24.25 | 20.9974 | $6824.16 |

How is Assessment related to taxes?

To learn about how your property is assessed, please visit our Property Assessment page.

Council, through the budget process, decides what budget the Municipality needs in the coming year. Then, using the total municipal-wide assessed property base, Council sets the total mill rates to bring in the funds it needs from property taxes.

The CNP Seniors Housing Board requests an operational budget from Council based on operational needs. Council will review the request and set the rate. Then, using the total municipal-wide assessed property base, the mill rate is set to bring in those funds to be transferred to the CNP Seniors Housing Board.

The Alberta School Foundation Fund is set by the province. The Municipality receives an invoice from the province detailing what is owed to the Alberta School Foundation Fund. Then, using the municipal-wide assessed property base, Council sets the Residential School rate to collect the money required to send to the province.

If you would like to request a Tax Search ($15) or a Tax Certificate ($25), please send your request via email taxroll@crowsnestpass.com.

Property Tax Payment Information

Property Tax Assessments and Notices are mailed by April 30 of each year. Please note that as per the Municipal Government Act Section 335, the Municipality must mail assessments to property owners. Please ensure we have your current mailing address on file.

- If you have not received your property tax bill please phone the Taxation Department at the Municipal Office at (403) 562-8833 to obtain a copy

- If you have changed your mailing address call (403) 562-8833 or email taxroll@crowsnestpass.com

- Non-receipt of your property tax bill does not exempt you from late payment penalties.

- When you purchase a property, adjustments for taxes are made between the vendor and purchaser.

Property Taxes are due on June 30 each year unless you are on the pre-authorized payment plan. Payments can be made in the following ways:

Mail: Mail payment to Municipality of Crowsnest Pass, Box 600, Blairmore, AB T0K 0E0. The effective date of payment will be the date of the postmark by Canada Post. If this is absent or illegible, the effective date of payment will be the actual date of receipt by the Municipality of Crowsnest Pass. The imprint of a postage meter is not acceptable proof of the date of mailing.

Municipal Office: Payment by cash, cheque, interact payment can be made during business hours from 8:30 - 4:30 pm. Night deposit is also available. All cheques must be payable to the Municipality of Crowsnest Pass. Cheques are conditional payment until honoured. Penalties will apply for any dishonoured payment. Payments tendered with any conditions attached will not be accepted. All payments will be applied firstly to arrears of taxes and secondly to current tax.

Financial Institutions, Online and/or Telephone Banking: Payment can be made at most chartered banks, trust companies, credit unions and Alberta Treasury Branches. Payments are made in-person, via the telephone or if you have internet access, you can pay your bill online. From your financial institution's online banking site, locate the Municipality of Crowsnest Pass (taxes) as the payee and your tax roll number will be the account number. (Please note: Payee name may be entered differently depending on the bank, using a broad search such as 'crowsnest' tends to work best. Contact your bank if you have any difficulties. Please note that it will take up to three business days to process these type of payments. Plan your payment accordingly to meet any deadlines.

Post-dated Cheques: Cheques must be dated on or before June 30 to avoid tax penalties.

Pre-authorized Payment Plan: Monthly penalty-exempt pre-authorized property tax payment plans are available. Persons using this plan make twelve equal monthly or twenty-four bi-monthly payments instead of one annual lump sum payment on the tax due date. For further details, please contact the Municipal Property Tax Department at (403) 562-8833.

Mortgage Company Payments: Some mortgage agreements include property taxes. If your mortgage agreement includes property taxes (called PIT - principal, interest & property taxes) your mortgage company is responsible for notifying the tax department. Once they have notified us, the Municipal tax department will send a copy of the amount of property taxes owed for the year and you will continue to receive the original Property Assessment and Tax Notice. The Property Assessment and Tax Notice contains a box labelled "Copies" that will list your mortgage company. If this name does not appear on your bill and you believe you pay PIT, please contact your mortgage company immediately to avoid incurring penalties.

The Municipality will not mail you a receipt unless you request one. To request a Property Tax Payment Receipt, please contact the Taxation Department at 403-562-8833, taxroll@crowsnestpass.com, or in person at the Municipal office located at 8502 - 19 Avenue, Coleman during regular business hours.

Senior's Tax Rebate

The Senior's Tax Rebate is designed to protect qualified low income senior citizen home owners who are receiving the Federal Guaranteed Income Supplement.

Procedure

The applicant must complete the tax rebate application form and provide evidence that they are eligible for the Federal Guaranteed Income Supplement (T4OAS) to the Taxation Clerk. You can apply for the Senior’s Tax Rebate from May 1 to December 15. Your property tax levy must either be paid or you must be on the pre-authorized payment plan and in good standing before applications are processed.

Please Note:

- This policy will only apply to a resident home owner's personal primary residence.

- No rebate will be given for tax increases that result from increased assessment due to additions to a resident home owner's property.

- The Finance Department shall ensure eligible resident home owners receive the appropriate refund or credit to their tax roll.

- Refunds of less than $5.00 will not be made.

- Taxes must be paid and/or in good standing.

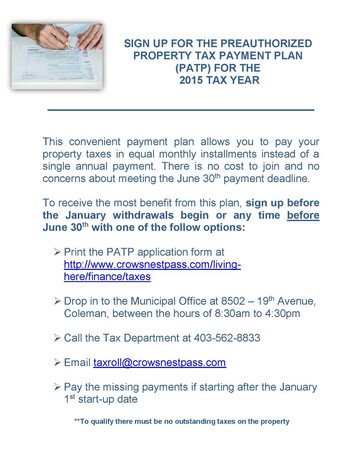

Preauthorized Payment Plan for Taxes

- Property taxes are always paid in the current taxation year. The plan runs from January through December during the current taxation year.

- In January, payments are calculated using the previous year’s levy which is divided by either twelve or 24 to set up a monthly withdrawal on the 15th or 30th or a twice monthly withdrawal on the 15th and 30th.

- Payments are debited directly from either a chequing or savings account.

- Preauthorized payments are re-calculated twice: once in January and again after the new tax levy has been processed for the current taxation year. After recalculating, letters will then be sent to all taxpayers using the direct debit option advising of the new monthly payment amount in effect to December of that year.

- A tax notice will still be mailed to all registered owners; however those persons using the preauthorized payment plan are NOT required to pay the balance by the due date. They simply continue making monthly payments as was arranged. No penalties are incurred on the preauthorized plan.

- The preauthorized payment plan contract must be completed, signed and returned to the Municipal office in order to be eligible for the payment plan.

- The plan can be cancelled via written authorization from the registered owner of the property two weeks prior to the next scheduled payment.

- Any payments returned for non-sufficient funds, frozen accounts etc. can immediately result in termination of the plan. The tax account would then be subject to all relevant penalties.

Please contact the Tax Clerk at (403) 563-2203 or email taxroll@crowsnestpass.com

Tax Forms

Senior's Property Tax Deferral Program

Pre-Authorized Tax Payment Form

Pre-Authorized Tax Payment Cancellation Form

Seniors UT Rate Reduction and Tax Rebate Form

Assessment Review Complaint Form (this form must be downloaded and viewed with a pdf viewer, it will not open in your internet browser)

Assessment Information Request Form

Link to the Public GIS https://gis.orrsc.com/Html5Viewer/index.html?viewer=CrowsnestPass_Public.CrowsnestPass

Property Tax Exemptions in Alberta

This Guide is intended to be helpful to members of non-profit organizations, municipal administrators, property assessors, and others who have an interest in property tax exemptions.

The scope of this Guide is limited and it does not include information about exemptions for farm residences and buildings, linear property (power lines, wells, pipelines, etc.), or machinery and equipment. For more information, please refer inquiries to the Assessment Services Branch by calling (780) 422-1377 or toll-free by first dialing 310-0000. You may also choose to e-mail a municipal advisor at lgsmail@gov.ab.ca.

The application for a property tax exemption must be made to the municipality by November 30 of the year before

the tax year (unless the application deadline is waived by the municipality. Any information required by the municipality is to be supplied no later than the following February 15.